Overview

In our latest study, we investigated the correlation between petrol prices, inflation, and their related online conversations with a specific focus on Pakistan and the post-pandemic global economic recovery. We wanted to see how social media conversations around inflation and price increases (especially fuel prices) were correlated against actual prices and inflationary data and the extent of their influence on one another.

Our focus was on highlighting not only key trends and patterns related to the above but also on identifying some of the most prominent voices both within and outside Pakistan dominating online discourses on inflation.

Methodology

To do this, we gathered and analyzed inflation-related hashtags that had trended in Pakistan over the last 24 months (1 January 2020 – 20th December 2021). We then compared these against over 78,000 tweets based on the keyword “inflation,” which comprised a randomized sample of ~5000 tweets for each month. This dataset was used for further screening out major trend patterns, hashtags, and key accounts.

Our data on Inflationary trends was sourced from the World Bank’s Open Data on Consumer Prices and the Pakistan Bureau of Statistics’ monthly inflation figures. Data for fuel prices in Pakistan was sourced from Pakistan State Oil’s monthly price archives.

Insight 1:

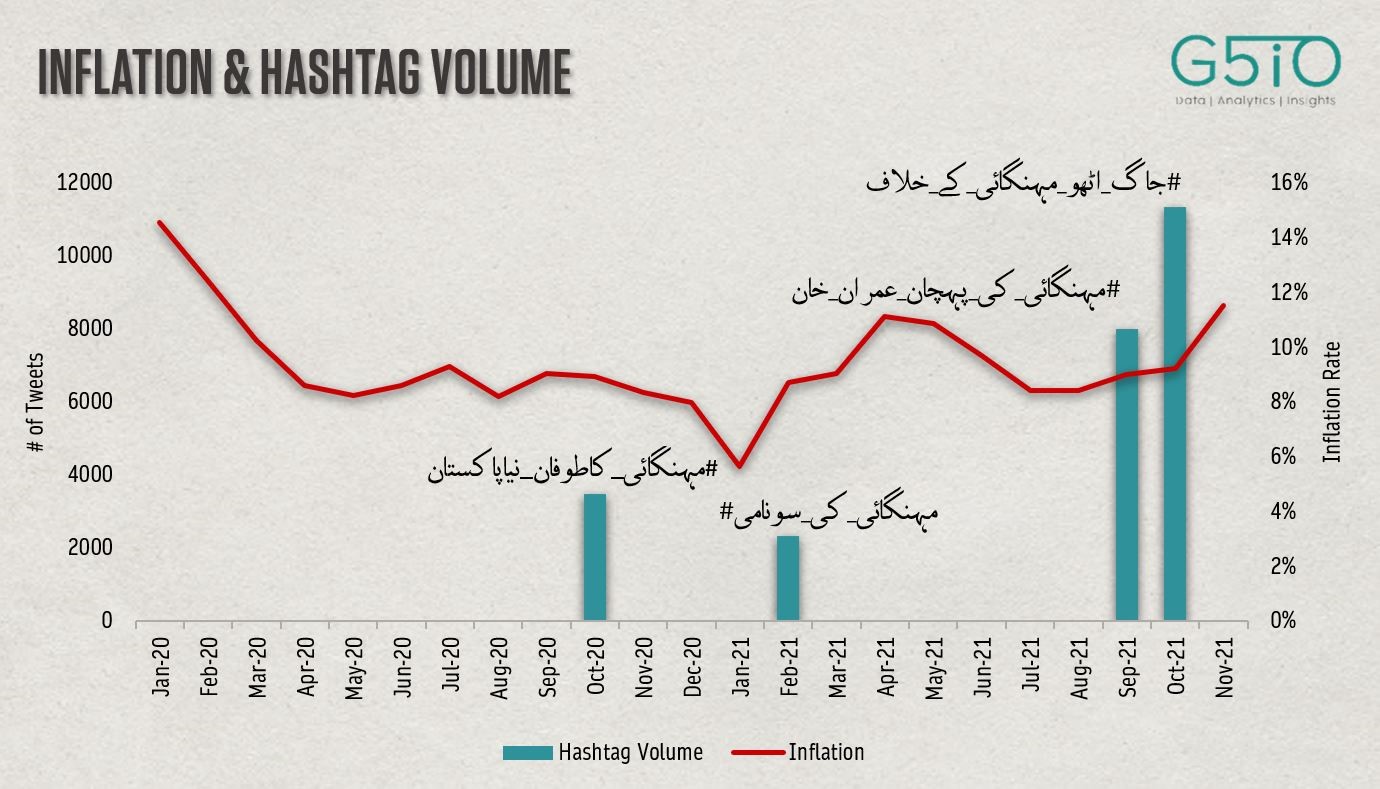

One of the most immediate economic consequences of the COVID pandemic felt across the world was a steep reduction in inflation rates as the global economy came to a grinding halt. This is reflected in the sharp decline in inflationary pressures in Pakistan from Jan to Apr 2020 as well as continued deflationary pressures which persisted throughout that year. In contrast, 2021 saw inflation rates more than double in just the first 4 months, peaking once again by the end of the year.

When compared against major Twitter trends related to inflation, the most recent surge in Twitter conversations centered around trends like #مہنگائی_کی_پہچان عمران خان and #جاگ_اٹھو_مہنگائی_کے_خلاف coincides with this rise of about 25% in the inflation rate (i.e., from 9.2% in Oct to 11.53% in Nov’21). The same holds true for #مہنگائی_کی_سونامی which trended in early 2021 following a near 54% increase in the inflation rate (from 5.7% in Jan to around 8.7% in Feb).

However, the hashtag #مہنگائی_کاطوفان_نیاپاکستان which trended in October 2020 appears to have been pushed for purely political reasons as deflationary pressures from the pandemic were still in play. Interestingly, this was when opposition parties under the banner of the PDM (Pakistan Democratic Movement) were holding demonstrations in Islamabad against the ruling government.

Insight 2:

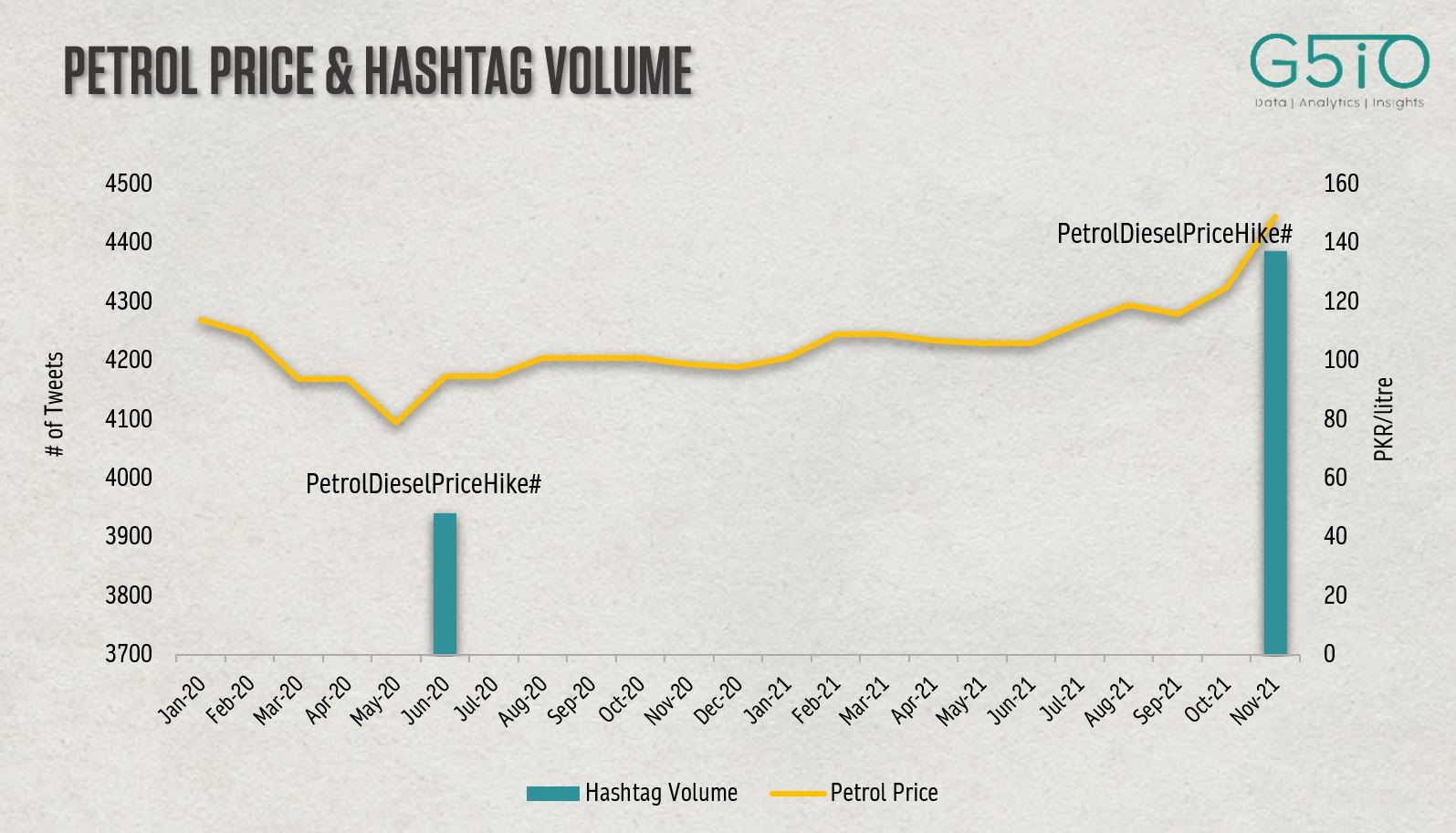

Whereas Twitter trends related to inflation are more likely to have an element of politicization by their very nature, trends directly related to fuel price hikes nevertheless share a stronger correlation with actual prices even when pushed for political reasons.

For instance, petrol prices saw a sharp decline during the first half of 2020 owing to global supply chain issues and a significant drop in demand. Following this, fuel prices increased sharply in June ’20, which corresponds with the first petrol/diesel related hashtag to have emerged in our data related to Pakistan. Similarly, petrol prices were stable between April ’21 and July ’21 with little if any significant online trends occurring during this period.

The rise in petrol specific chatter related to in the last three months, however, relates directly to the exceedingly sharp increases in petrol prices. This has not only coincided with rising inflation rates, but also other online trends related to inflation as discussed below.

Insight 3:

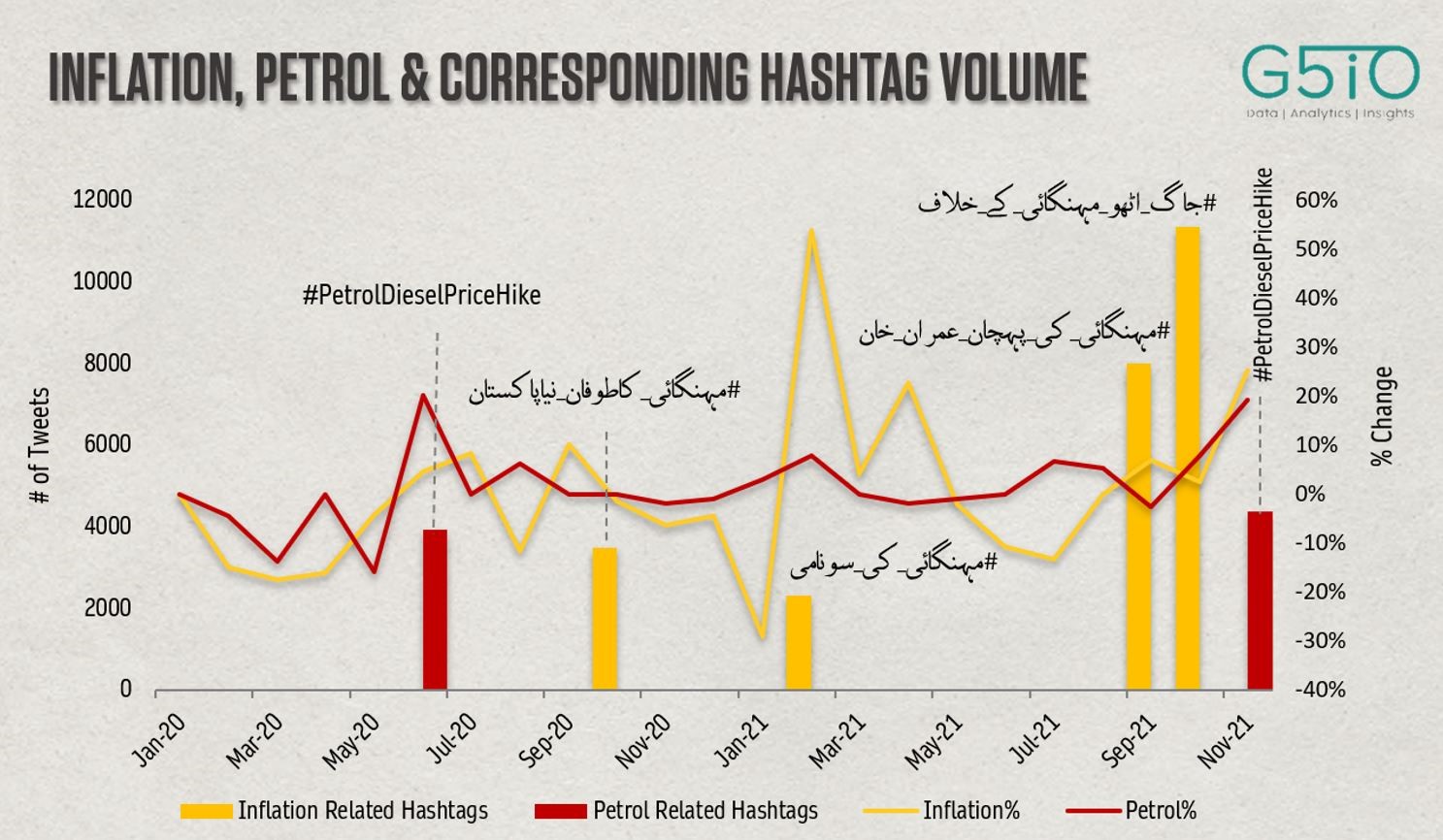

Looking at the combined data on petrol prices and inflation rates for Pakistan, we can see that changes in fuel prices act as a leading indicator to subsequent changes in the inflation rate. For instance, each of the inflation spikes (as indicated by the yellow line) have been preceded by spikes in fuel prices (red line). So too has the response on Twitter (red bars) which interestingly has only coincided directly with steep price hikes of around 20% as seen in June 2020 and December 2021.

However, for Twitter trends directly referring to inflation (yellow bars), there is a marked lag in the sense that it has taken time for the effects of inflation to mobilize into an online show of discontent – even if such trends have in themselves been politically motivated. This, for instance, is evident in all 3 of the inflation related-hashtags plotted for this year. If we are to go by the same pattern while looking at current inflation rates, it is likely that more of such trends are to follow in the coming months.

Taking a closer look at these online trends specifically related to inflation, there is also an element of seasonality to these campaigns. For instance, both years saw politically charged hashtags related to inflation trending in October. However, there is still a major difference considering that this year saw a much higher volume of tweets – more than double – coinciding with an actual rise in the inflation rate as well as petrol prices compared to October 2020.

Insight 4:

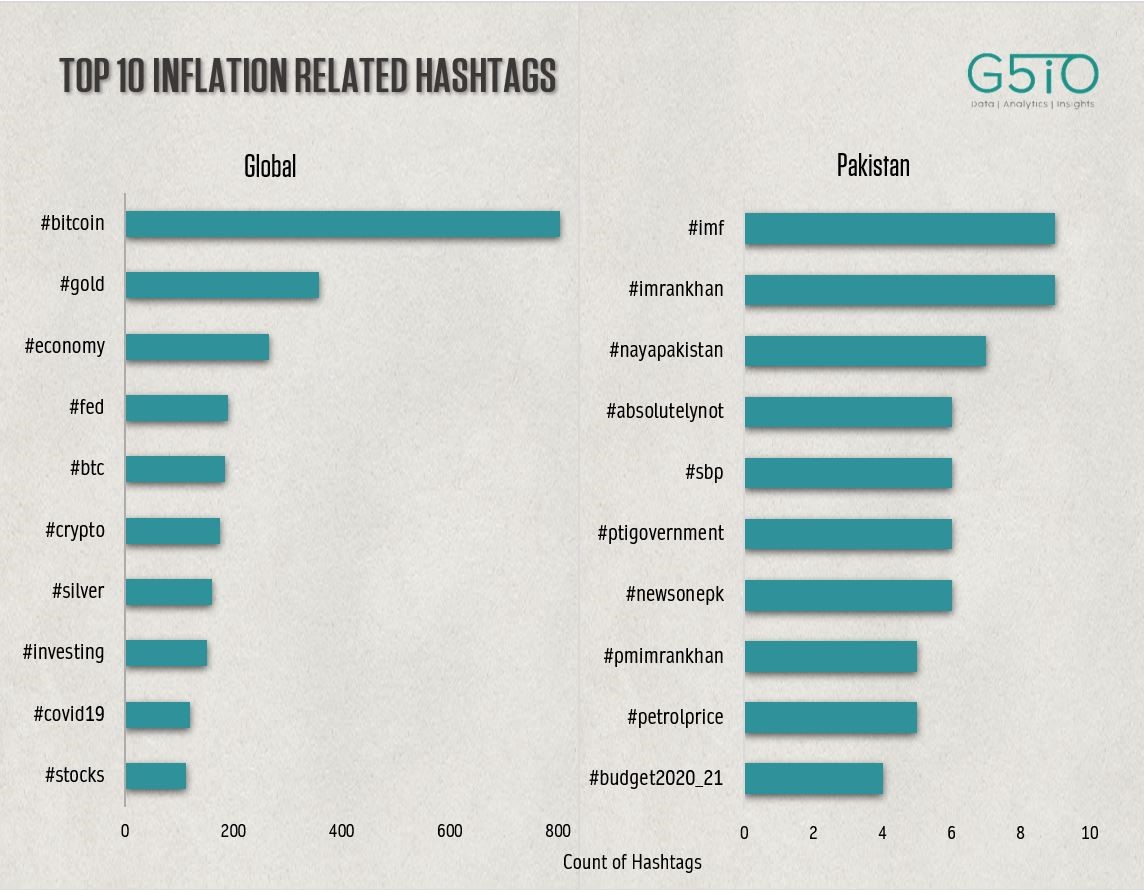

Considering that the context of this study is rooted in the post COVID ‘global’ economic recovery, we also wanted to see what the actual content of the online discourse related to inflation comprised of. This was done by looking at the top hashtags associated with inflation both within Pakistan and the world at large. What we saw was a highly interesting divergence in terms of not only what was being attributed as the ‘causes’ of inflation but also ways to tackle or ‘hedge’ against it.

For instance, based on the most frequently used hashtags associated with inflation on Twitter, we saw that #bitcoin followed by #gold were the top most used hashtags across the world. This was linked directly with how online conversations were centred more on the US #FED’s impact on the global #economy – mostly through its expansionary fiscal policy – and its knock-on effects on commodity and #stock prices such as #silver over the last 2 years. Not to mention the impact of #Covid19. Hence, comprising the main reason why both #bitcoin and #gold were being discussed online primarily as viable hedges against inflation.

Hashtags related to inflation in Pakistan however, stood in stark contrast to global trends with the #IMF and politics related trends instead dominating online discourse. More specifically, 5 out of the top 10 hashtags referred directly to the ruling government with only 3 comprising actual economic-related trends such as #petrolprices, the #budget2020_21 and the #SBP (State Bank of Pakistan). What’s perhaps most interesting however is that almost all of these hashtags are directed solely at assigning blame and attributing the ‘causes’ of inflation to politics – as opposed to more economic and finance-related discussions on tackling or even hedging against inflation.

Insight 5:

A deeper look into the most frequently used words within these trends presents a similar yet more nuanced divergence. The major difference here however being the varying priorities of consumers/ investors in the developing vs the more developed world. For instance, ‘insurance’ (costs), ‘drug prices’ and ‘taxpayers’ featured predominantly in the broader global discourse on inflation. Thus, reflecting some of the most pressing concerns stemming from a post-pandemic global economy. In Pakistan however, online conversations were instead reflective more of general discontent as consumers expressed concerns over their ‘buying’ (purchasing) ‘power’, the ‘economy’ in general, and fears of ‘hyperinflation’.

Insight 6:

In addition to ‘what’ was being discussed and ‘when’, we also wanted to find out ‘who’ were the major voices leading the last two years’ twitter discourse on inflation. Especially those accounts that have been ‘verified’ as having established credibility

At the global level, these include some of the most prominent US politicians, entrepreneurs/investors and journalists pushing both politicized as well as more policy-oriented narratives. For instance, Donald Trump Jr.’s and the House GOP accounts were the most prominent political actors pushing the US Republican party’s narrative against the Biden government’s inability to curb inflation. Yet, there were also the likes of seasoned economists such as Steven Hanke, Robert Reich and Peter Schiff offering policy insights and genuine economic analyses that gained significant traction.

In Pakistan, while the distribution of key voices was somewhat similar, there were a lot more political actors and journalists leading the conversation and that too with little if any economic expertise. Thus, representing a dearth of relevant experts and economists leading online conversations on inflation. Hence, serving as one of the primary reasons why the discourse has been more politicized, and problem-oriented as opposed to being more solution-orientated from both a policy and research perspective.

Conclusion

One of the key underlying premises guiding our study was the fact that economic discourses both on mainstream and digital mediums play a key role in shaping consumer and investor perceptions. Social media discourses similarly while representing a dialectic relationship represent both the cause and effect of these discourses. In essence offering a unique insight into how narratives of economic growth, progress and prosperity are being shaped and reshaped across different markets, time-periods, and regions.

In the case of inflation – especially in the context of the post pandemic global economic recovery – we found that social media discourses while comprising politicized motives and narratives were a lot more politicized in Pakistan than the world at large. This was due to mainly two key factors

- Inflation related discourses in Pakistan’s digital spaces were more problem- oriented. i.e., focused more on assigning blame and labelling the attributive causes of inflation on to the the ruling government and/or the IMF

- There was a significant dearth of subject matter ‘experts’ leading online discussions on the Pakistani economy with the current discursive space being dominated by politicized pundits

However, a comparison of these online conversations when plotted against actual inflation rates and fuel prices revealed a strong correlation between price fluctuations and the general discontent on social media. This was despite such narratives being politicized where sharp fluctuations – especially of around 20% and above – generated significant rises in social media chatter related specifically to inflation and fuel price hikes.

Download PDF:

Inflation in a Post-COVID World: Comparing Twitter Conversations in Pakistan & Abroad